Overview

This article is dedicated to helping small businesses navigate the complexities of calculating, claiming, and optimizing deductions related to Qualified Business Income (QBI) for maximum tax benefits. We understand that tax season can be overwhelming, and it’s crucial to grasp the significance of QBI and Section 199A. By outlining clear steps for accurate calculation and highlighting common pitfalls to avoid, we aim to illustrate how these strategies can lead to meaningful tax savings and foster business growth.

Imagine the relief of knowing you’re taking full advantage of every deduction available to you. With the right knowledge, you can transform your tax situation and reinvest those savings back into your business. Let’s explore these essential strategies together, ensuring you feel empowered and supported every step of the way.

As you delve into these insights, keep in mind the importance of asking questions and reflecting on your unique circumstances. We’re here to guide you through this process, offering practical advice that resonates with your experiences as a small business owner. Together, we can achieve success and ensure your hard work pays off in the best possible way.

Remember, understanding QBI and Section 199A is not just about compliance; it’s about making informed decisions that benefit your business. By following these steps and avoiding common mistakes, you can unlock significant tax savings that will help your business thrive. Let’s take this journey together, and make the most of the opportunities available to you.

Introduction

Understanding Qualified Business Income (QBI) is crucial for small business owners who want to optimize their tax strategies and enhance their financial health. Imagine being able to deduct up to 20% of your QBI—this potential can significantly reduce your taxable income, leading to increased cash flow and more opportunities for reinvestment. However, we understand that navigating the complexities of QBI calculations and the benefits of Section 199A can be challenging. Many small business owners find themselves wondering: how can you effectively leverage these deductions to fuel your growth and avoid common pitfalls? Together, we can explore these strategies and empower your business to thrive.

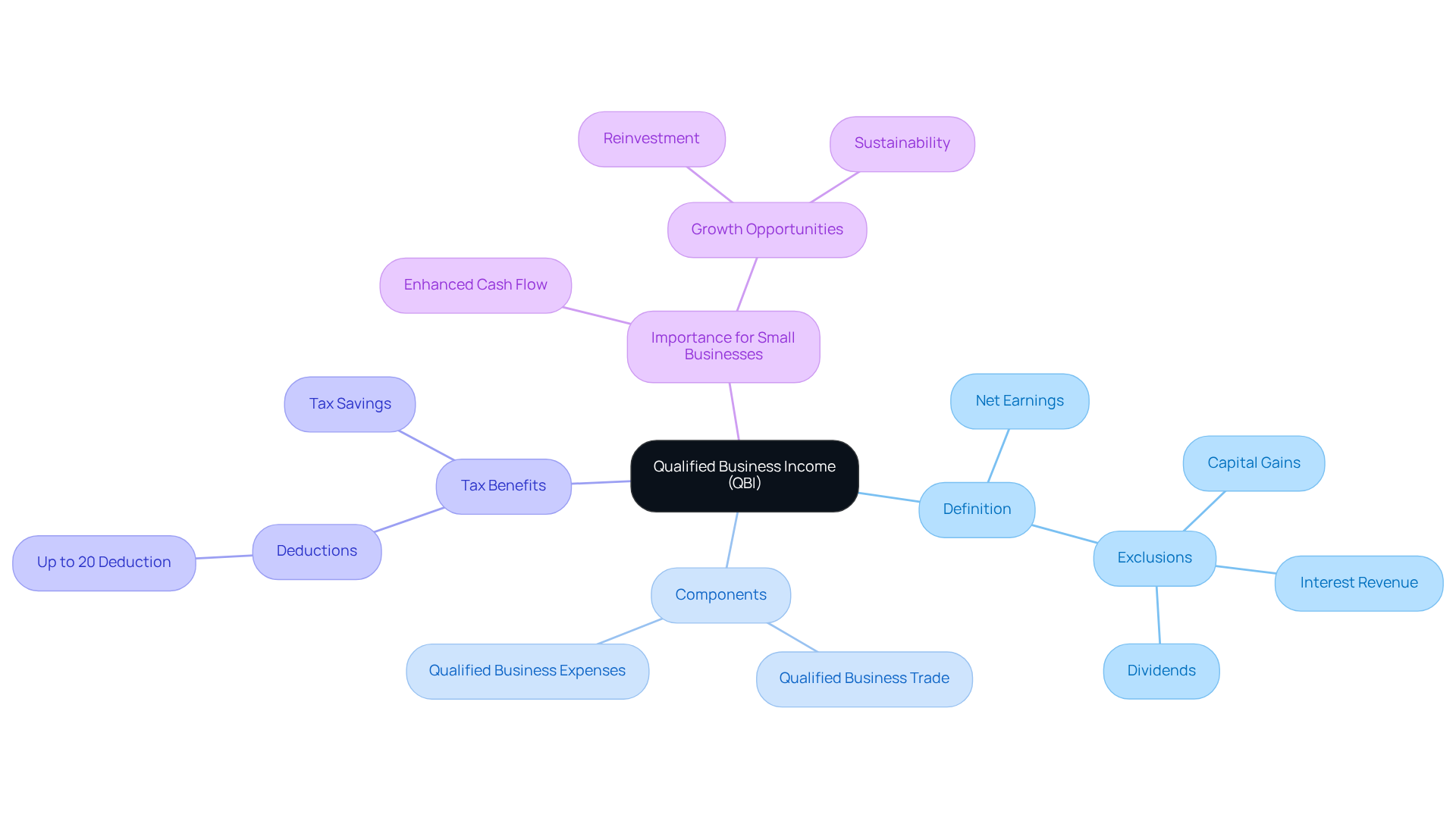

Define Qualified Business Income and Its Importance for Small Businesses

Qualified Business Income (QBI) refers to the net earnings from a qualified business trade or enterprise, excluding capital gains, dividends, and interest revenue. For small business owners, understanding qualified business income (QBI) is essential, as it can significantly reduce taxable income through various qualified business expenses. The QBI allowance allows taxpayers of a qualified business to deduct up to 20% of their QBI, leading to substantial tax savings. This reduction is particularly impactful for qualified businesses, enhancing cash flow and opportunities for reinvestment, ultimately fostering growth and sustainability. By recognizing the importance of a qualified business, small business owners can better navigate their financial strategies and improve their tax positions.

Have you considered how QBI might benefit your business? By taking advantage of this allowance, you can not only save on taxes but also reinvest in your enterprise, paving the way for future success. Together, we can explore these opportunities and empower your financial decisions, ensuring you feel supported every step of the way.

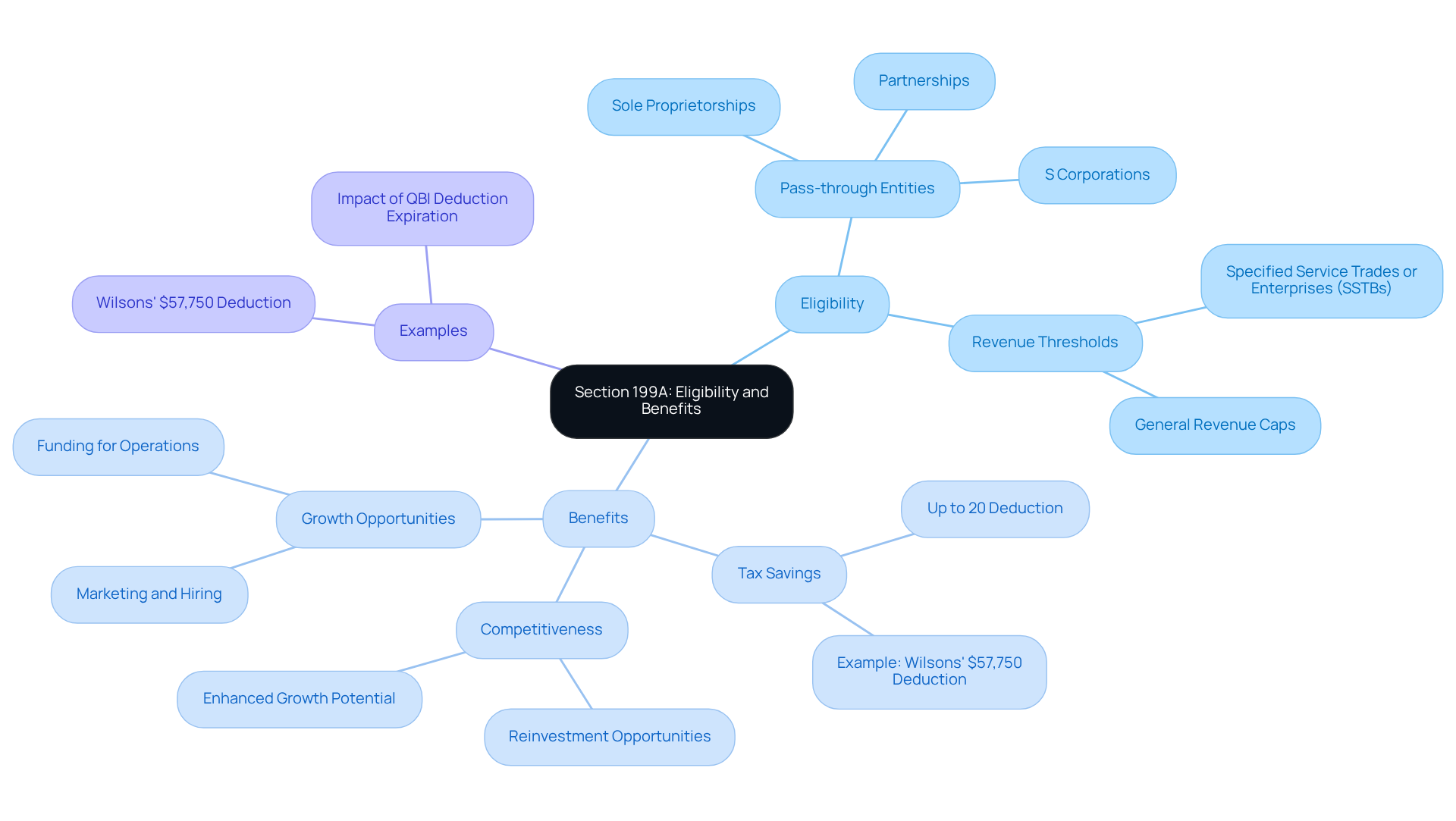

Explore Section 199A: Eligibility and Benefits for Small Business Owners

Section 199A provides a wonderful opportunity for qualified businesses to claim a reduction of up to 20% of their eligible enterprise earnings (QBI). If you operate as a pass-through entity—such as a sole proprietorship, partnership, or S corporation—you may qualify for this benefit. However, it's important to be aware of specific revenue thresholds and limitations, especially for specified service trades or enterprises (SSTBs), which face stricter revenue caps. For instance, the Wilsons can allocate $57,750 in pass-through enterprise income eligible for the deduction under Section 199A. Understanding these eligibility criteria is crucial for qualified businesses eager to .

The benefits of Section 199A go beyond mere tax savings; they can significantly enhance your company's competitiveness and provide essential resources for growth and development. Imagine being able to reinvest those savings into operations, marketing, or hiring—this can truly foster growth and innovation. As a CLA tax advisor wisely notes, "Without the QBI allowance, you will need to reevaluate your tax planning strategies to reduce the effect of increased taxes." By thoroughly exploring Section 199A, small entrepreneurs can uncover valuable opportunities to refine their tax strategies and improve the financial health of their qualified business. It’s also vital to remember that the QBI reduction is scheduled to end at the close of 2025, highlighting the urgency for entrepreneurs to enhance their tax strategies now. Together, we can navigate these complexities and work towards achieving your business goals.

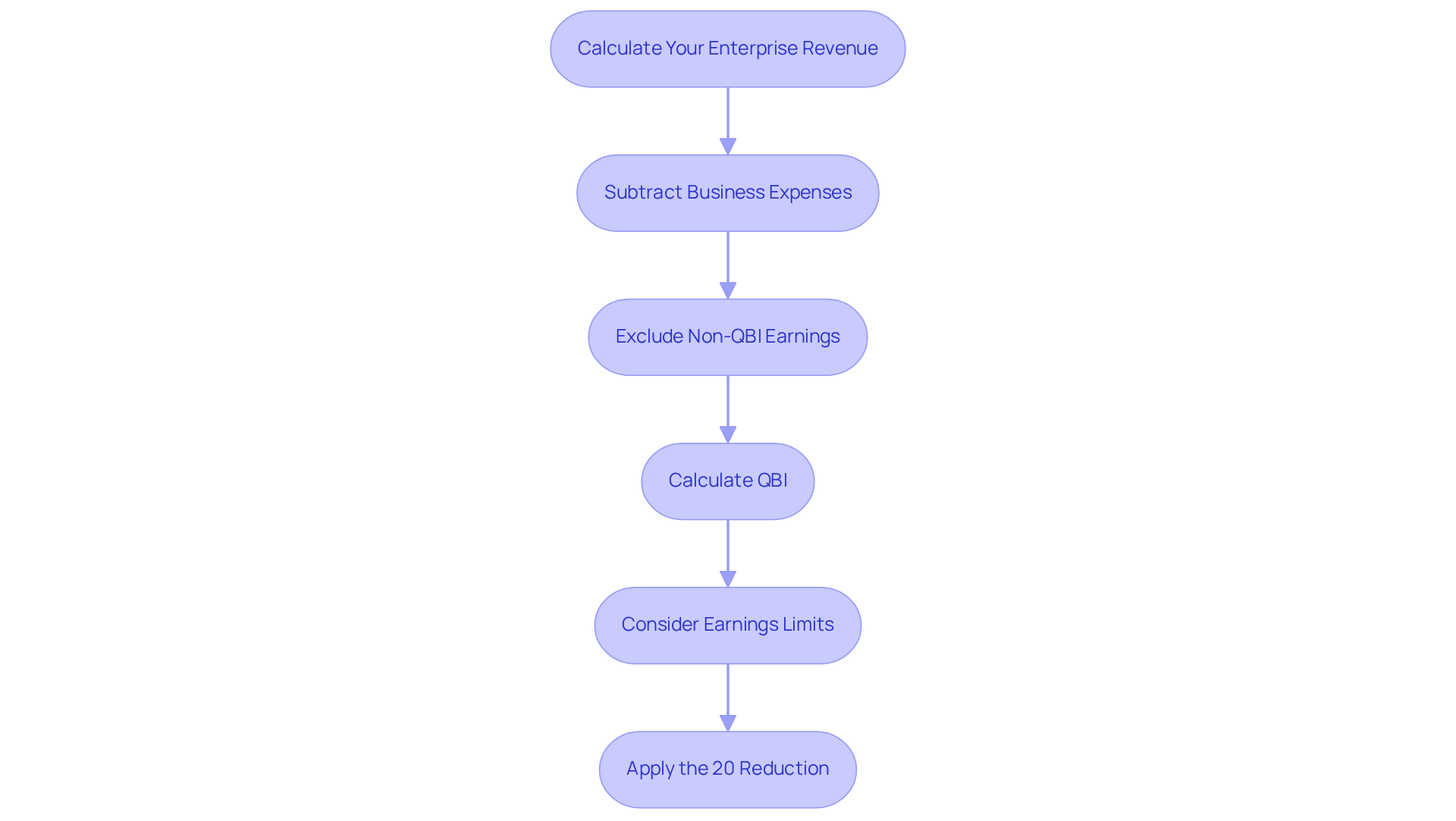

Calculate Qualified Business Income: Step-by-Step Guide

To calculate your Qualified Business Income (QBI) and make the most of your tax deductions, let’s walk through these essential steps together:

- Calculate Your Enterprise Revenue: Start with your total enterprise revenue from your tax return. You can typically find this on Schedule C for sole proprietors or Form 1065 for partnerships.

- Subtract Business Expenses: Next, deduct all typical and necessary business costs. This includes operating expenses, salaries, and any other deductions that help lower your taxable earnings.

- Exclude Non-QBI Earnings: It’s important to remove any capital gains, dividends, or interest revenue from your total earnings, as these do not qualify for the subtraction.

- Calculate QBI: The figure you arrive at after these subtractions is your QBI. For instance, if your total earnings are $100,000 and your expenses are $30,000, your QBI would be $70,000.

- Consider Earnings Limits: Keep in mind that if your income is below the threshold of $182,100 (or $364,200 for married couples filing jointly), the QBI reduction is calculated using Form 8995. If your income exceeds these thresholds, you will need to use Form 8995-A, which comes with additional limitations.

- Apply the 20% Reduction: Lastly, calculate 20% of your QBI to find your potential allowance. In this case, 20% of $70,000 results in a $14,000 reduction.

By following these steps, small business owners can accurately calculate their qualified business income (QBI), ensuring they maximize their tax benefits and improve their financial outcomes related to their qualified business. It’s also essential to consider the impact of self-employment tax and other deductions on your QBI figure. Remember, the QBI computation can be intricate, so thorough recordkeeping and compliance with regulations are crucial. Together, we can navigate these complexities and work towards your financial success.

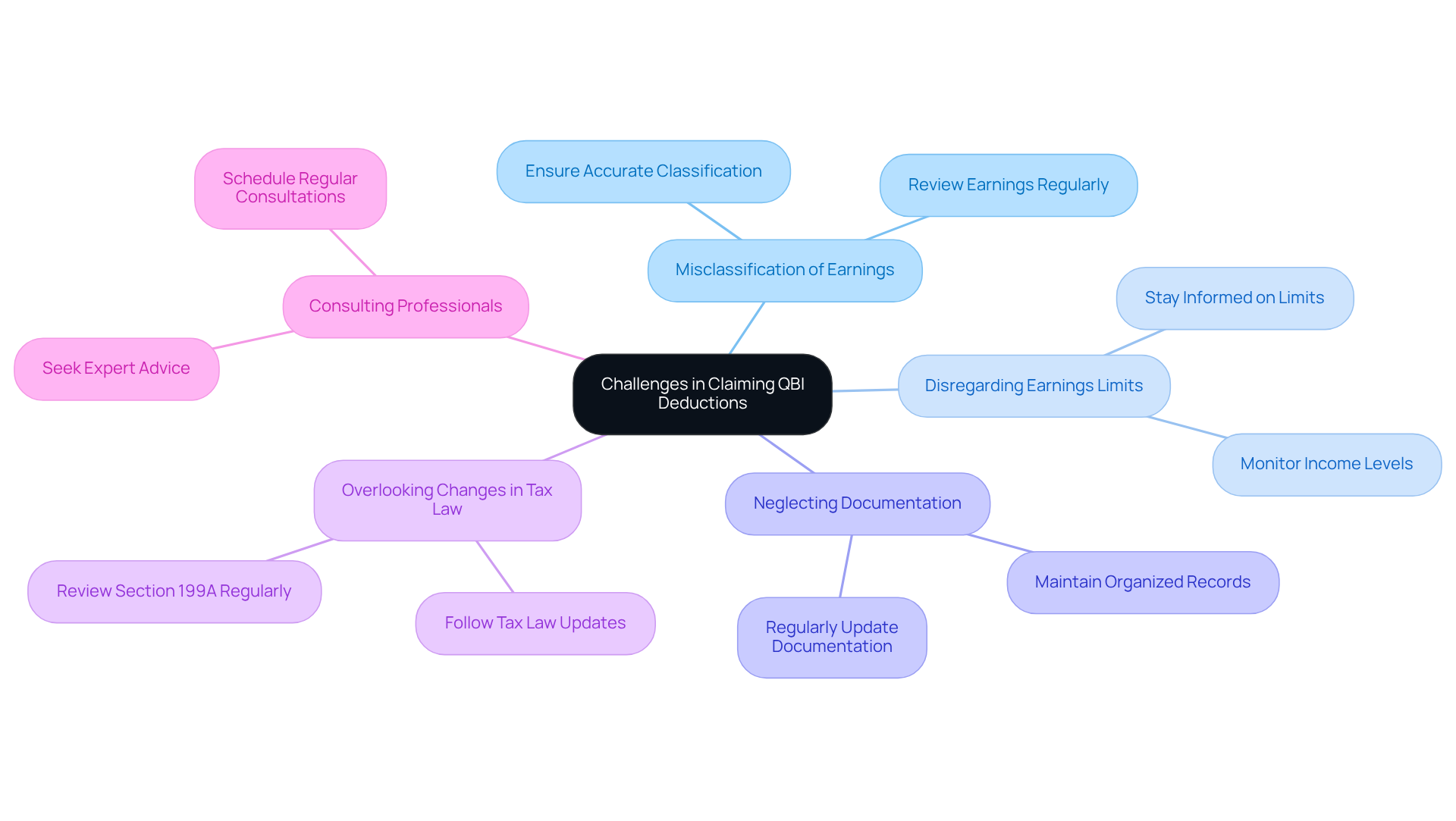

Identify Challenges and Avoid Pitfalls in Claiming QBI Deductions

Claiming QBI deductions can indeed present challenges, and we understand how daunting this process can feel. Here are some common pitfalls to be aware of, along with supportive strategies to help you navigate them:

- Misclassification of Earnings: It’s crucial to ensure that all your earnings are accurately classified as QBI. Misclassifying capital gains or other non-QBI earnings can lead to incorrect calculations and potential audits, which no one wants to face.

- Disregarding Earnings Limits: Be mindful of the earnings limits that can affect your eligibility for the deduction. Exceeding these limits may disqualify you from receiving the full allowance, and being informed can help you avoid this situation.

- Neglecting Documentation: Keeping thorough records of all income and expenses related to your business is essential. Insufficient documentation can result in rejected claims during tax audits, so maintaining organized files can save you stress down the line.

- Overlooking Changes in Tax Law: Tax laws can change, impacting your eligibility and the calculation methods. Staying informed about updates to Section 199A or related regulations is vital to ensure you’re not caught off guard.

- Consulting Professionals: If you’re ever in doubt, reaching out to a tax professional who understands QBI can be incredibly beneficial. They can provide tailored advice that saves you time and helps prevent costly mistakes.

By identifying these challenges and implementing strategies to avoid them, you can confidently navigate the QBI deduction process. Together, we can maximize your tax benefits and support your business’s growth.

Conclusion

Understanding Qualified Business Income (QBI) is vital for small business owners who wish to optimize their tax strategies. By effectively leveraging QBI, businesses can significantly decrease their taxable income, which can lead to meaningful tax savings and improved cash flow. This knowledge empowers entrepreneurs to make informed financial decisions that can ultimately drive growth and sustainability in their enterprises.

This article explores the specifics of Section 199A, illustrating how eligible businesses can claim a deduction of up to 20% of their QBI. We emphasize the importance of accurate recordkeeping and compliance with regulations as key steps for calculating QBI. Additionally, we address common challenges and pitfalls in claiming these deductions, providing strategies to navigate them successfully. This comprehensive approach enables small business owners to maximize their tax benefits and enhance their overall financial health.

In conclusion, the significance of QBI and Section 199A cannot be overstated for small business owners. By proactively engaging with these tax strategies, entrepreneurs can not only save on taxes but also reinvest in their businesses, paving the way for future success. It is essential to stay informed about eligibility criteria and potential changes in tax laws, ensuring that businesses are well-prepared to take full advantage of available deductions. Embracing these opportunities together will lead to greater financial resilience and a more competitive edge in the market.

Frequently Asked Questions

What is Qualified Business Income (QBI)?

Qualified Business Income (QBI) refers to the net earnings from a qualified business trade or enterprise, excluding capital gains, dividends, and interest revenue.

Why is understanding QBI important for small business owners?

Understanding QBI is essential for small business owners because it can significantly reduce taxable income through various qualified business expenses.

How much can taxpayers deduct from their QBI?

Taxpayers of a qualified business can deduct up to 20% of their QBI, leading to substantial tax savings.

What are the benefits of the QBI deduction for small businesses?

The QBI deduction enhances cash flow and opportunities for reinvestment, ultimately fostering growth and sustainability for small businesses.

How can small business owners improve their financial strategies with QBI?

By recognizing the importance of a qualified business and leveraging the QBI deduction, small business owners can better navigate their financial strategies and improve their tax positions.