Overview

This article delves into the concept of 'qualified clients,' shedding light on their key characteristics and their significance in investment strategies. We understand that navigating the financial landscape can be challenging, and recognizing the importance of qualified clients is crucial for making informed decisions. These clients must meet specific financial criteria, such as:

- A net worth exceeding $2.2 million

- Possessing $1.1 million in managed assets

This eligibility allows them to explore higher-risk investment opportunities and engage in performance-based fee structures, aligning the interests of advisers with those of their clients.

By understanding these distinctions, you can better position yourself to take advantage of unique investment opportunities that may arise. Together, we can explore how being a qualified client can open doors to tailored investment strategies that truly resonate with your financial goals. Remember, the journey toward financial success is not just about numbers; it's about building a partnership that supports your aspirations.

Introduction

In today's complex financial landscape, understanding what it means to be a qualified client is essential. The ability to access higher-risk investment opportunities can significantly influence your wealth growth. This article explores the key characteristics and criteria that define a qualified client, emphasizing their vital role in shaping investment strategies and the regulatory framework surrounding them.

With recent changes to eligibility thresholds, you might be wondering: how can you navigate these evolving requirements to ensure you are positioned for the best financial outcomes? Together, we can address these challenges and empower you to make informed decisions.

Define Qualified Client: Essential Characteristics and Criteria

Understanding eligibility under the Investment Advisers Act of 1940 can feel overwhelming, but we’re here to help clarify it for you. An eligible participant, as outlined by Rule 205-3, is a qualified client who meets specific economic criteria designed to ensure that they can engage in higher-risk investment opportunities. To be classified as a qualified client, an individual must have:

- A net worth exceeding $2.2 million, excluding the value of their primary residence, or

- Possess at least $1.1 million in assets managed by the adviser when entering into an advisory agreement.

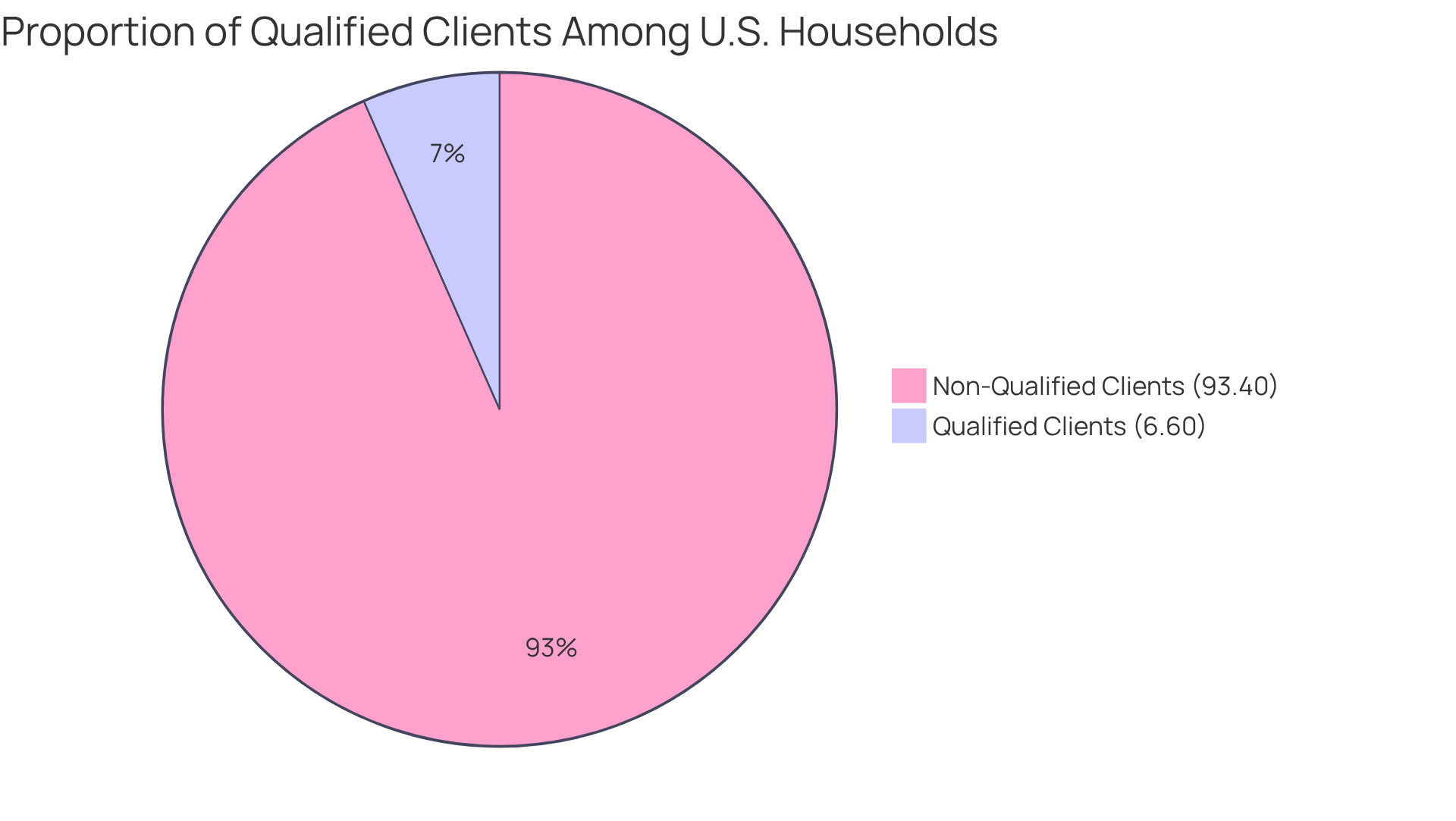

These thresholds are not just numbers; they reflect the SEC's commitment to protecting investors by ensuring that only those with substantial economic expertise can access certain investment strategies. As of 2025, these criteria have been adjusted to account for inflation, highlighting the importance of maintaining a robust economic profile. Did you know that approximately 8,666,220 households in the U.S. qualify under these guidelines? That represents about 6.60% of all households in 2023. This statistic shows that you are not alone in navigating these financial waters.

Moreover, qualified clients have the opportunity to be charged performance-based fees, which can significantly impact their investment journey. It’s also worth noting that the net worth threshold was recently raised from $2.1 million to $2.2 million, reflecting ongoing changes in the economic landscape. We understand that these adjustments can be challenging, but they are designed to ensure that you are equipped with the knowledge and resources necessary to make informed decisions. Together, we can navigate these complexities and find the best path forward for your financial future.

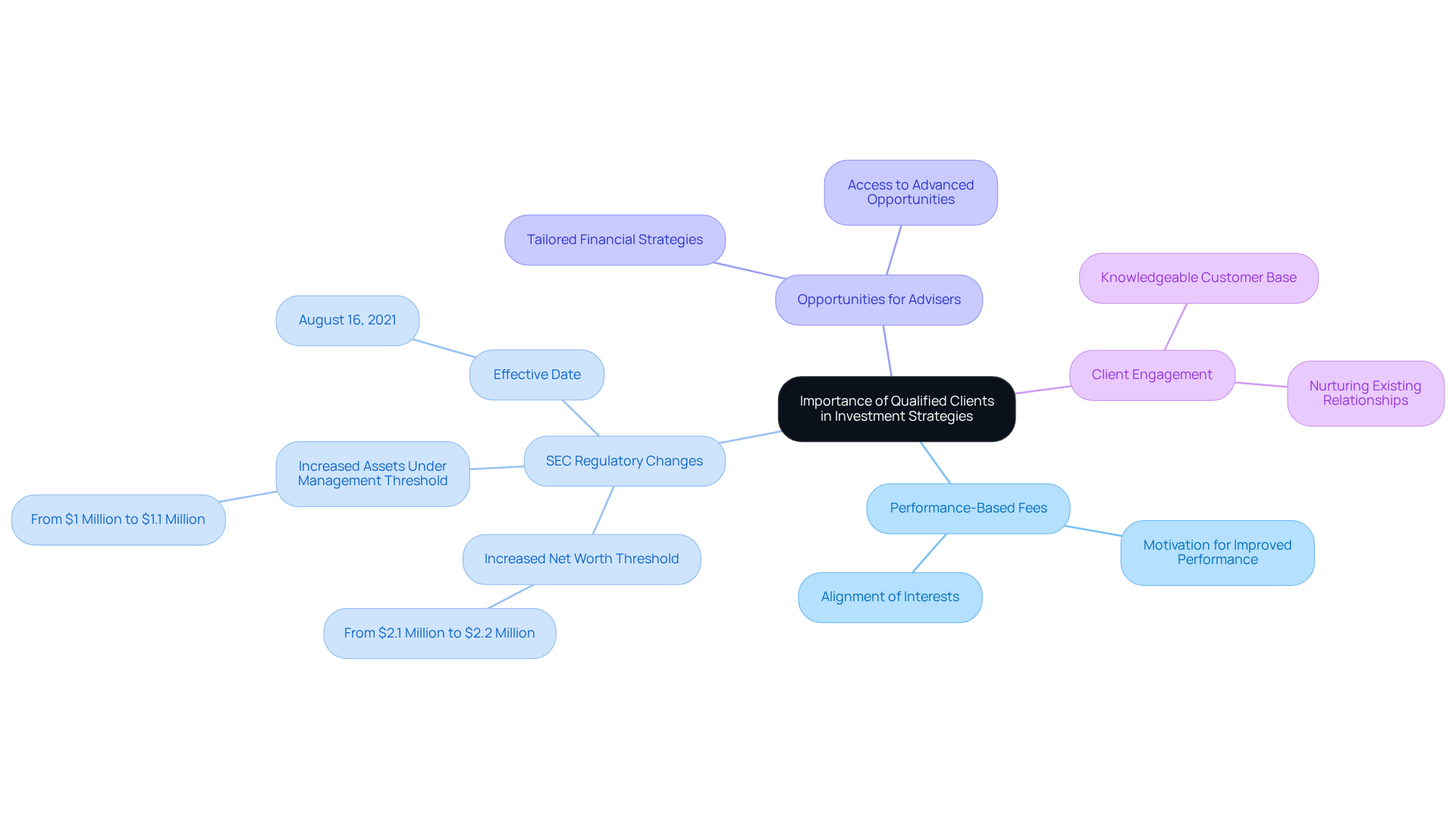

Explain the Importance of Qualified Clients in Investment Strategies

Qualified clients play a vital role in financial strategies, allowing financial advisers to implement performance-based fees. This approach not only motivates improved performance but also aligns the adviser’s interests with those of the customer. Imagine the possibilities this creates, especially in private equity and hedge fund allocations, where taking on greater risks can lead to substantial returns. By working alongside a qualified client, advisers can tailor financial strategies that reflect their clients' unique monetary capabilities, ultimately opening doors to advanced opportunities that may remain out of reach for the general public.

Recent adjustments by the SEC have elevated the thresholds for eligible individuals, raising the net worth requirement from $2.1 million to $2.2 million, and assets under management from $1 million to $1.1 million. This change signifies a growing recognition of the importance of these individuals in the financial landscape. As Patrick Dundas noted, 'Qualified Client Assets-Under-Management and Net Worth Test Amounts Increased to $1.1 and $2.2 Million, Respectively.' This shift encourages a more engaged and knowledgeable customer base, which is essential for achieving successful financial outcomes.

Moreover, the new thresholds take effect on August 16, 2021, underscoring the timeliness of this information. Current customers who are considered qualified clients under the previous thresholds are grandfathered in, enabling advisers to nurture these relationships while adapting their strategies to meet the evolving needs of qualified individuals. Together, we can navigate these changes and ensure that your financial journey is as rewarding as possible.

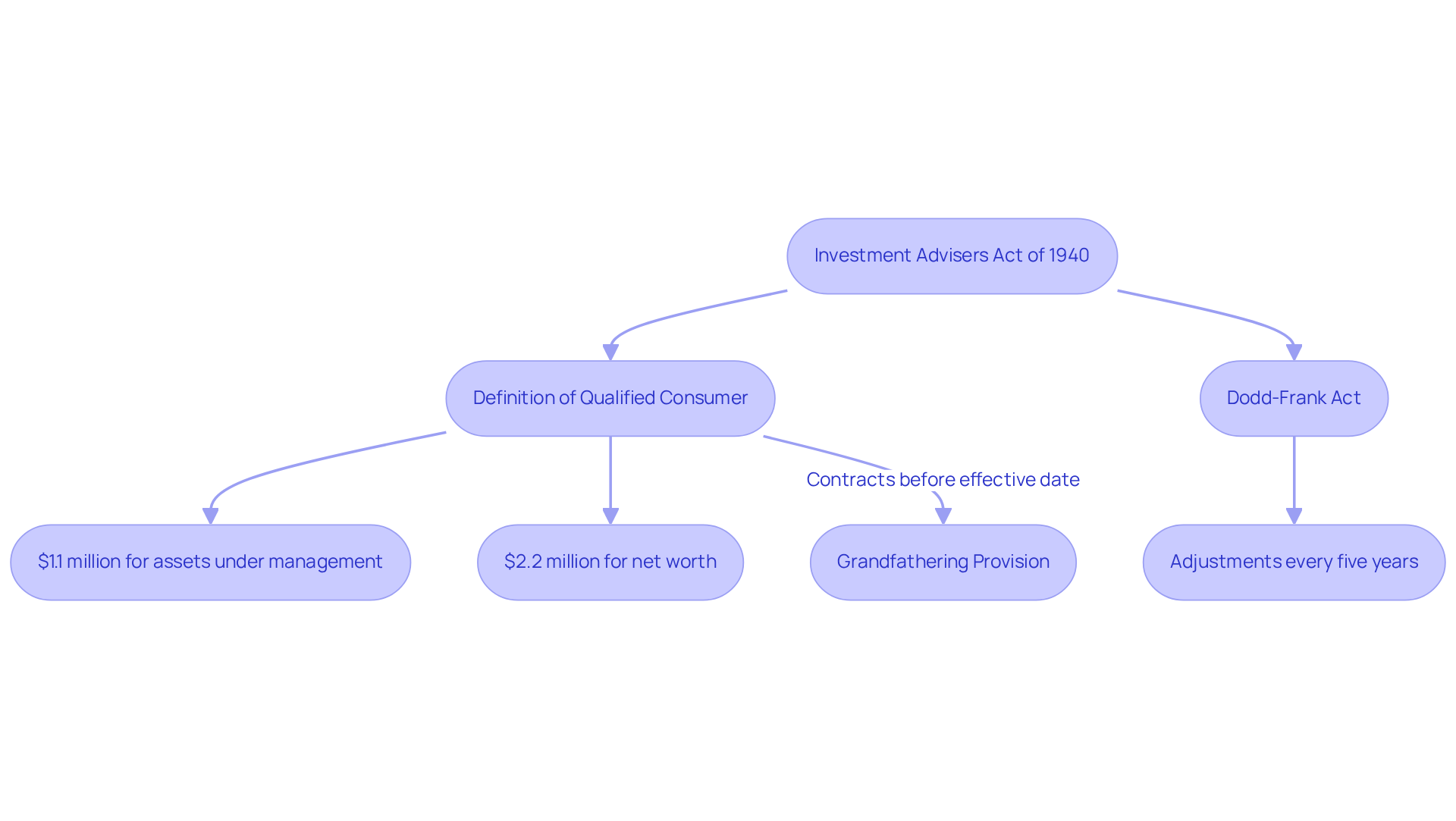

Trace the Origins and Regulatory Framework of Qualified Clients

The concept of a qualified consumer originated from the Investment Advisers Act of 1940, which aimed to protect investors by regulating the actions of financial consultants. Over time, the Securities and Exchange Commission (SEC) has adapted this definition to reflect the evolving economic landscape and inflation adjustments. Most recently, on August 16, 2021, the asset limits for qualified individuals were increased to:

- $1.1 million for assets under management

- $2.2 million for net worth

This change ensures that only those with substantial economic resources can access certain opportunities, offering a layer of protection for less experienced investors.

This regulatory framework is designed to empower qualified clients to engage in more complex strategies that require a deeper understanding of economic principles. Additionally, the Dodd-Frank Act requires the SEC to adjust these financial thresholds approximately every five years based on inflation, ensuring that the definition remains relevant and aligned with current economic conditions. For clients with contracts established before the effective date, there is a grandfathering provision under the previous thresholds, which provides continuity amid these regulatory changes.

As Matthew Cook, Senior Counsel, noted, 'The amendments are effective on November 10, 2021.' This highlights the ongoing evolution of our regulatory framework, reflecting our commitment to safeguarding investors while enabling informed participation in the financial landscape. Together, we can navigate these changes and ensure that you are well-prepared for the opportunities that lie ahead.

Differentiate Qualified Clients from Accredited Investors and Qualified Purchasers

In the financial landscape, it's important to recognize the distinctions between accredited investors, qualified purchasers, and qualified clients. Each of these categories has specific financial thresholds that impact access to valuable opportunities. For instance, accredited investors are individuals who have a net worth of at least $1,000,000 or an annual income exceeding $200,000. This status opens doors to private funding opportunities that are typically not available to the general public, which is crucial for engaging in private equity prospects.

On the other hand, eligible individuals face even higher economic requirements, needing a net worth of over $2.2 million or $1.1 million in managed assets. This classification allows them to enter into performance-based fee agreements, which can be advantageous for both clients and financial advisers. It's essential to stay informed about the SEC's adjustments to these thresholds, as they emphasize the importance of understanding these categories in today's financial environment.

Qualified buyers, meanwhile, are individuals or entities with a minimum of $5 million in assets. This designation grants them access to a broader array of funding opportunities with fewer regulatory limitations, making it a highly sought-after status for serious investors.

Understanding these distinctions is vital for advisors, as it empowers them to tailor their services effectively for a qualified client and ensure compliance with regulatory standards. As of 2022, the number of American households qualifying as accredited investors has surged, reaching over 18%. This trend underscores the growing significance of financial literacy and awareness in navigating these categories. By staying updated on the SEC's threshold adjustments, advisers can better serve their clients and enhance investment strategies, ensuring that together, we can achieve financial success.

Conclusion

Understanding the concept of a qualified client is crucial for navigating the complexities of investment opportunities. These individuals, defined by specific financial thresholds, are equipped to engage in higher-risk strategies that can lead to significant returns. By meeting the criteria established under the Investment Advisers Act of 1940, qualified clients not only gain access to exclusive investment options but also benefit from performance-based fee structures that align the interests of advisers with their own financial goals.

This article highlights the essential characteristics that distinguish qualified clients from other investor categories, such as accredited investors and qualified purchasers. Have you considered how recent adjustments to the financial thresholds might affect your investment strategy? It’s important to understand the implications of these changes for both clients and advisers. Moreover, we emphasize the historical context and regulatory framework that have shaped the definition of qualified clients, reinforcing the need to stay informed about these evolving criteria.

Ultimately, recognizing the significance of qualified clients in the financial landscape is vital for making informed investment decisions. As the thresholds continue to adapt to economic conditions, it becomes increasingly important for both advisers and clients to understand their roles within this framework. Engaging with the complexities of qualified client status not only empowers individuals to take advantage of advanced investment strategies but also fosters a more knowledgeable and proactive approach to financial management. Together, we can navigate these challenges and achieve success in your investment journey.

Frequently Asked Questions

What is a qualified client under the Investment Advisers Act of 1940?

A qualified client is an eligible participant who meets specific economic criteria outlined by Rule 205-3, allowing them to engage in higher-risk investment opportunities.

What are the criteria to be classified as a qualified client?

To be classified as a qualified client, an individual must have either a net worth exceeding $2.2 million (excluding the value of their primary residence) or at least $1.1 million in assets managed by the adviser when entering into an advisory agreement.

Why are these thresholds important?

These thresholds reflect the SEC's commitment to protecting investors by ensuring that only individuals with substantial economic expertise can access certain investment strategies.

Are the criteria for qualified clients subject to change?

Yes, as of 2025, the criteria have been adjusted to account for inflation, emphasizing the importance of maintaining a robust economic profile.

How many households in the U.S. qualify as qualified clients?

Approximately 8,666,220 households in the U.S. qualify under these guidelines, representing about 6.60% of all households in 2023.

What benefits do qualified clients have?

Qualified clients have the opportunity to be charged performance-based fees, which can significantly impact their investment journey.

Has the net worth threshold changed recently?

Yes, the net worth threshold was recently raised from $2.1 million to $2.2 million to reflect ongoing changes in the economic landscape.